TSI #37: How to invest like the biggest funds in the world?

Mar 12, 2023Hello Stoic Investors,

Today I want to focus on something big. In fact, I want to focus on the biggest money funds in the world.

Imagine a vast pool of wealth, accumulated over generations, and entrusted to safeguard the future of a nation.

This is the essence of a sovereign wealth fund, a formidable financial entity that represents the aspirations, hopes, and dreams of a people.

You could call them “state-owned investment funds”.

I know what you’re thinking.

Why should you care?

Sovereign wealth funds are among the largest institutional investors in the world, with combined assets exceeding several trillions of dollars.

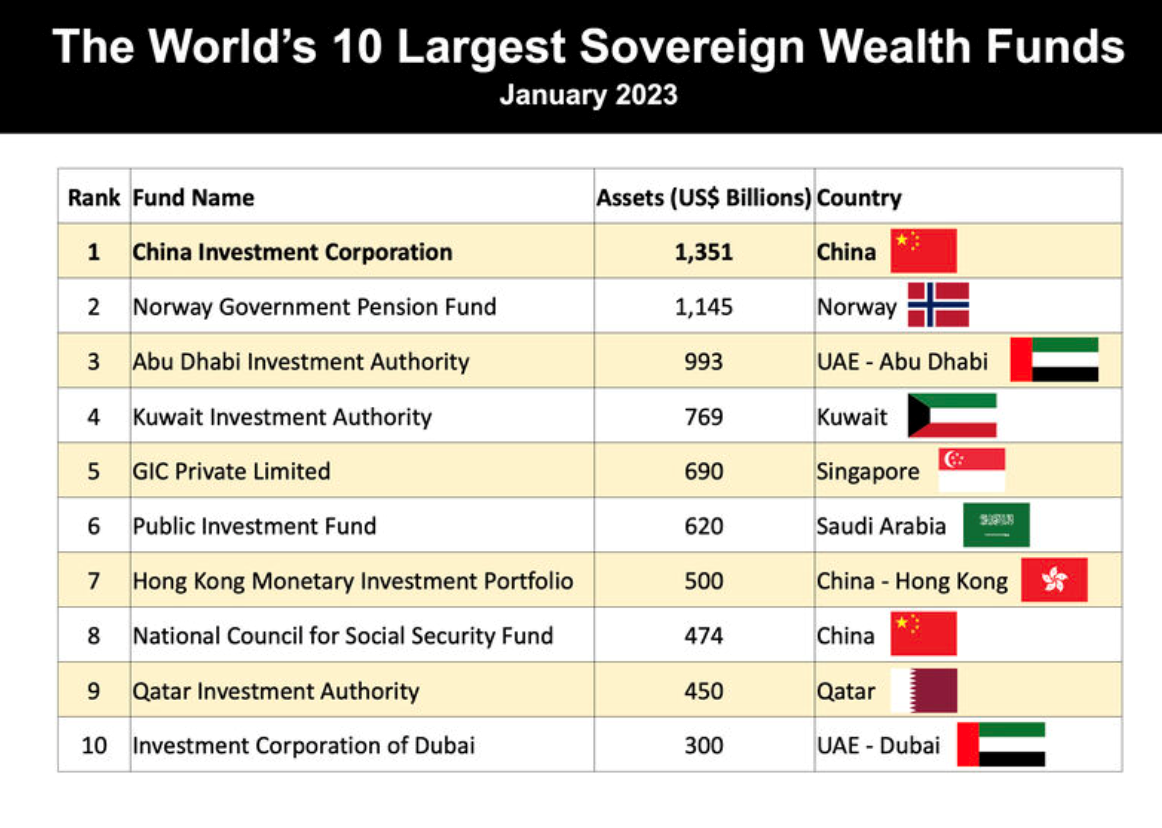

Just look at this chart.

Apple is the largest company in the world with a market cap of $2.4 trillion. You would need 563 Apples to match the size of China Investment Corporation.

Their investments can significantly impact financial markets and the global economy.

How?

Through shifting the market.

If you’re unsure what this means, then you’ll love this next section.

Why do sovereign wealth funds matter?

A big investment is enough to get the ball rolling.

Let me explain this through an example.

The Norwegian Government Pension Fund Global (GPFG), is one of the largest sovereign wealth funds in the world.

In 2018, the GPFG announced that it was divesting from coal companies due to environmental concerns. This decision led to a significant reduction in the value of several coal companies and created waves in the energy sector.

The sheer size of the GPFG and its ability to make large investments make it a major player in the global economy, and its investments can have far-reaching consequences for investors and the wider public.

I know what you’re thinking now.

Where can you find their buys and sells?

Some funds share that info and some do not.

For example, the previously mentioned GPFG does that. But not in real-time. You can find their past holdings here: https://www.nbim.no/

At the end of 2022, their largest positions were Apple, Microsoft, Google, Nestle and Amazon. To make things more interesting, their portfolio is diversified among 11,549 investments.

While they do not share their portfolio in real-time, they do share the total value of their fund. It’s worth $1343 trillion as we speak. That’s a big pile of money.

Nevertheless, you should never buy or sell anything just because a fund tells you to. However, by looking at what they’re doing, you can get a good feeling in which direction the global economy is leaning.

So, note down these points and start investing today:

- The largest funds are “state-owned”

- They can shift the market because of their size

- You can get a glimpse of the future by looking at their portfolios